Life. Wealth. Advice.

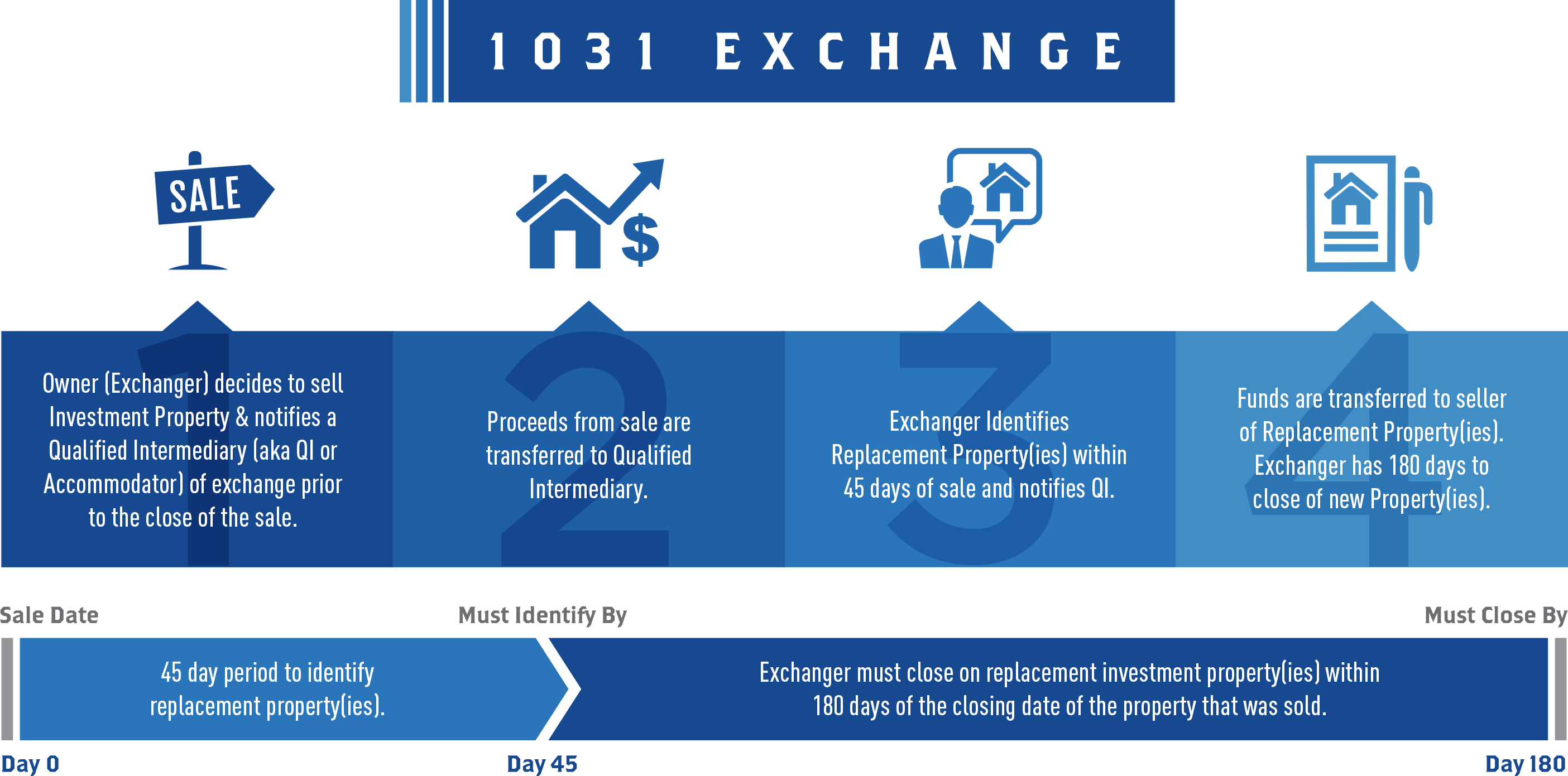

If you are considering the sale of investment real estate, it is important to consider a 1031 tax-deferred exchange. A 1031 exchange allows you to defer capital gains, depreciation recapture and investment taxes, while reinvesting the entire proceeds into other investment real estate. However, there are strict rules and timelines that must be followed. Clark Wealth Strategies, Inc. provides clients with methodical, fiduciary guidance throughout the entire exchange process.

Tax Deferral

Section 1031 of the Internal Revenue Code allows an investor to defer the payment of capital gains and depreciation recapture taxes that may arise from the sale of investment real estate. By using the proceeds of this sale to acquire “like-kind” real estate, taxes may be deferred, as long as the investor meets certain conditions and deadlines.

Three Basic Steps for Investors with Property to Exchange

- Exchanger sells property, known as the relinquished property, and proceeds are escrowed with a Qualified Intermediary (QI).

- Qualified Intermediary, through a written agreement with the investor, transfers funds for purchase of replacement properties.

- Exchanger receives beneficial interest in a DST.

Delaware Statutory Trusts (DSTs) as Replacement Properties

DSTs permit fractional ownership where multiple investors can share ownership in a single property or a portfolio of properties. Interests in a DST qualify as a replacement property as part of an investor’s 1031 exchange transaction.

Benefits of Delaware Statutory Trusts (DSTs)

No Management Responsibilities

DSTs are managed by professional, third-party firms. For investors transitioning from actively managing properties to passive ownership, this alleviates the burden of day-to-day management and replaces it with the freedom of time for travel and leisure.

Tax-Sheltered Monthly Income Distributions

Distributions from cash flow are paid monthly. Because DST investors are deemed to have direct ownership of real estate, the benefits of direct ownership, such as mortgage interest deductions and depreciation, flow through to investors on a pro-rata basis. Because of this, income from DSTs is often tax-sheltered, making for a greater tax-equivalent yield.

Diversification

Because of the fractional-ownership and low minimum investment of DSTs, clients are able to replace their investment with a portfolio of commercial real estate that provides diversification of asset class, geography and even DST sponsor. This helps to mitigate investment risk.

Ease of Ownership

The rules and deadlines of a 1031 exchange, such as the “45-day identification period,” can be difficult to maneuver. DSTs are pre-vetted and already acquired, ready for an investor’s exchange. The closing process into a DST can take as little as two business days. For investors at the end of their 45-day ID period who have not yet found a suitable replacement property, DSTs can offer an immediate and simple solution. For this same reason, DSTs also make for great back-up properties, in case there are complications with a sole-property acquisition.

Higher-Value

Real Estate

A DST is a pooled-equity investment which allows investors to collectively purchase a property of higher value by aggregating their equity together. This allows DST investors to purchase properties that would otherwise be out of a single investor’s reach. As an example, a DST investor could go from owning 100% of a local apartment to owning 1.20% of a $50 million class A apartment complex in Denver, CO.

Estate Planning

DSTs, like traditional real estate upon an owner’s passing, provide heirs with a step-up in cost basis. This means that heirs do not receive the owner’s original cost basis, but a “stepped-up” basis as of the date of death. This is true even if the owner has performed multiple 1031 exchanges. DSTs can also relieve the anxiety and problems that can occur when real estate is transferred to heirs.

Partial List of Current and Fully Subscribed Offerings

For a Full List, Contact Us

Interchange DST

Location(s): Riverview, FL (Tampa Metro)

Loan to Value: 0%

Minimum Investment: $76,500

Offering Type: Delaware Statutory Trust (DST)

1031 Exchange Qualified: Yes

Raleigh Pediatrics DST

Location(s): Raleigh, NC

Loan to Value: Various

Minimum Investment: $25,000

Offering Type: Delaware Statutory Trust (DST)

1031 Exchange Qualified: Yes

Dallas Medical Office DST

Location(s): Dallas, TX

Loan to Value: 66.21%

Minimum Investment: $73,984

Offering Type: Delaware Statutory Trust (DST)

1031 Exchange Qualified: Yes

Innsbrook DST

Location(s): Richmond, VA

Loan to Value: 0%

Minimum Investment: $99,000

Offering Type: Delaware Statutory Trust (DST)

1031 Exchange Qualified: Yes

Universal Studios DST

Location(s): Oriando, FL

Loan to Value: 0%-All-Cash/ Debt-Free

Minimum Investment: $100,000

Offering Type: Delaware Statutory Trust (DST)

1031 Exchange Qualified: Yes

The offerings shown above are representative of investments available in the Clark Wealth Strategies DST inventory. This is neither an offer to sell nor a solicitation of an offer to buy a DST interest. There is no guarantee that these objectives will be met.