Trading Approach

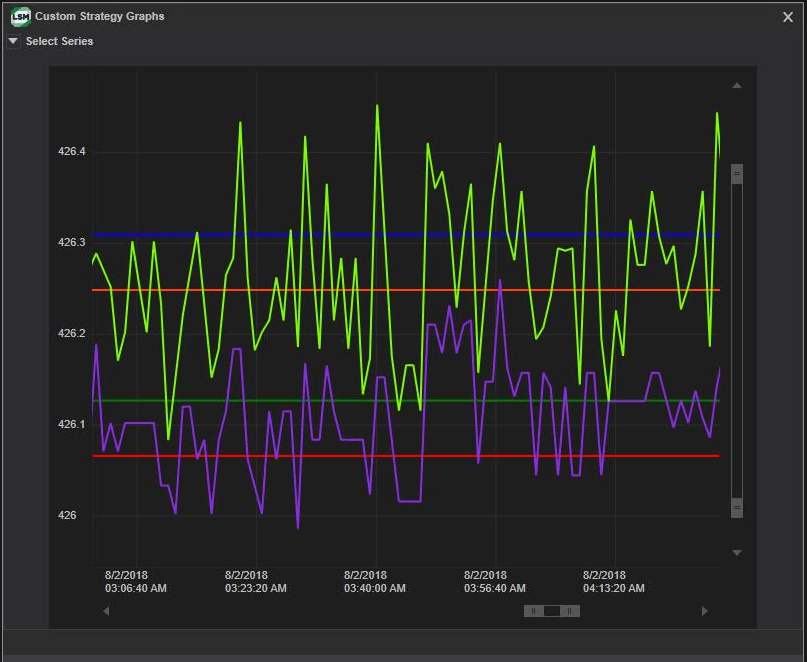

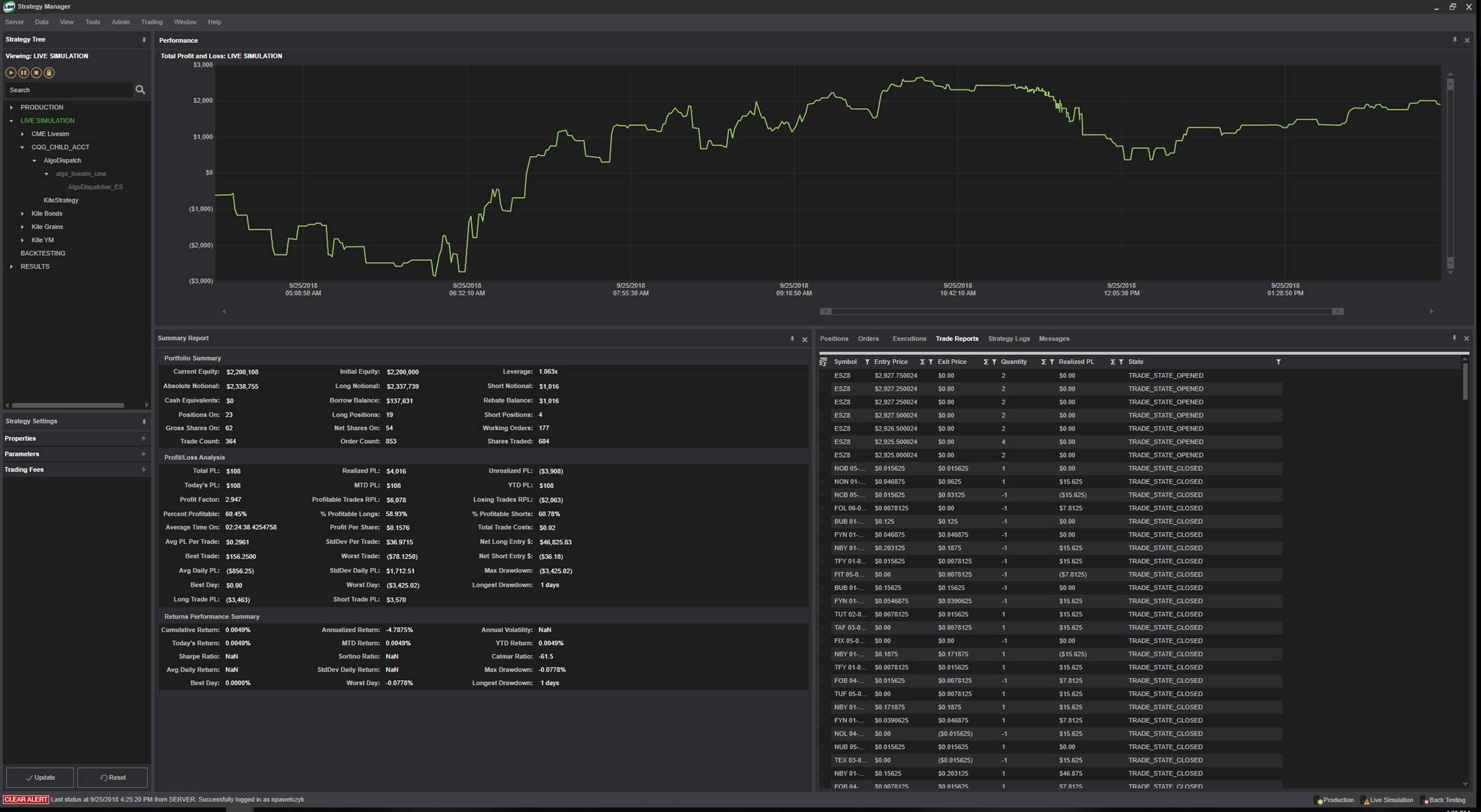

There are multiple ways to approach each and every CBOT product, which makes the use of an electronic platform so interesting. The ability to trade in different products offers great opportunities, and if approached the right way, can be very successful. The use of an industry leading trading suite like RCM-X Strategy Studio and its underlying low latency algos gives me back, and even surpasses the “edge” that I lost as I left the “open outcry” environment.

One of the most important approaches or philosophies I tried to stick to as a trader is to have more winning trades than losing trades by day’s end, while also keeping your losing trades relative to your winning trades. This approach can still be successful today, but the way to approach it is different than it was in “open outcry”. In the corn pit I would rely on getting the “edge” which meant I would have the opportunity to buy at a desirable bid, or sell at the desired offer, based on market conditions and my actions as a trader. Because of the anonymity of today’s trade, it is often hard to realize if you are getting the “edge” when buying or selling a certain product. This is where having the ability to electronic backtesting and actually simulate certain trade ideas is so important before going into actual production.

I enjoy discussing my approach to trading certain markets, but I also enjoy hearing how other approaches might work in those same markets. The futures industry is always changing, and having the flexibility as well as the willingness to change with the markets is essential.